posted 4th July 2025

If you've ever spent time on social media, you may have noticed a strange pattern. Quietly but persistently, adverts and “friendly reminders” pop up, inviting the public to use the Financial Ombudsman Service. It’s sold as a helpful, Free, Timely, Impartial, and Fair solution for resolving financial disputes. Simply submit your complaint, and they’ll take care of the rest. Or so we’re told.

But for those of us who’ve dealt with the financial sector in the real world, not through theory, not on paper, the idea that the FOS exists solely for the benefit of the public doesn’t quite stack up. There’s something off about how it all works, and once you start looking beyond the glossy messaging, the story begins to shift.

First, the FOS is entirely funded by the very institutions it's supposed to be policing. The banks and financial firms pay the bills every time a complaint is opened, and the company being complained about pays a fee.

Not only does this raise questions about impartiality, but it also suggests a built-in tension: the more complaints the FOS accepts, the more revenue it generates, but at the same time, those paying the fees are also the ones the FOS is meant to keep in check.

Regardless of how one seeks to justify such an arrangement, this dual role creates a murky middle ground where independence is more a matter of optics than practice. And if that weren’t enough, you only need to speak to a few people who’ve used the service or worked within it to hear the same thing: decisions often feel rushed, inconsistent, and far from thorough in their investigations.

One investigator still employed by the organisation told us, “That staff are constantly pushed to meet unrealistic targets”. Training, they said, “is patchy at best”. “New procedures are rolled out so often that even those handling cases aren’t always clear on what the current process is”. And when your job is to assess complex financial complaints, that lack of clarity has huge consequences for the consumer who depends on the integrity of the FOS.

Just a cursory glance at the FOS’s public reviews substantiates all the above comments. Trustpilot, Google, Glassdoor and other forums are filled with disappointed users. Some describe feeling ignored. Others say they received generic cut-and-paste templated replies that didn’t even reflect the specifics of their case. The phrases “rubber-stamping,” “ corrupt,” and “bias” are synonymous with the FOS.

Here’s something else the glossy marketing won’t tell you: 76% of all complaints are either rejected or not upheld. That’s not a typo. 76% of claims don’t result in success for the consumer. So yes, it’s easy to submit a complaint, but what are the odds of a positive result? A mere 24% of cases are upheld. It is noteworthy that the University of Warwick who are currently undertaking an in-depth study on the FOS. Its preliminary findings were that the FOS’s reported uphold rates were ‘disingenuous’ in that they reported upholding 37% of claims.

The study exposed the FOS’s attempt to mislead the public by including ‘token’ awards of £50.00 to £200.00 that financial institutions were ordered to pay for things like ‘stress and inconvenience’ when the substantive claim was rejected out of hand. The University of Warwick’s study show that the FOS’s published statistics were overly inflated, insincere and deliberately misleading.

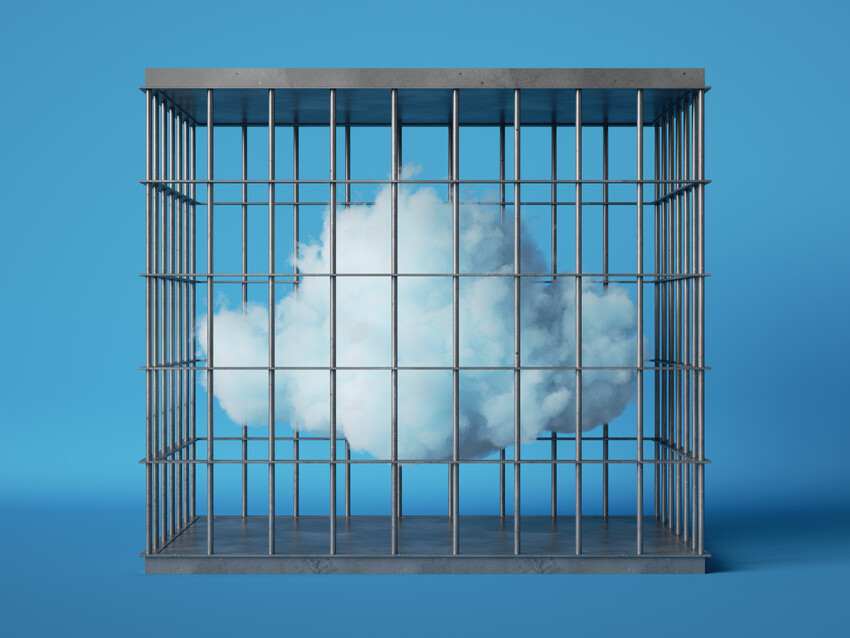

This raises a question that too few people are asking of FOS: Is the FOS genuinely protecting the public, or is it just helping clean up the reputational mess left behind by banks? The answer may depend on who you ask, but for many, the experience feels more like containment than justice.

If the FOS operated in the private sector, subject to market pressures and accountability, would it still be standing? It’s hard to say. Most businesses couldn't survive long if they overpromised and underdelivered on this scale. However, the FOS enjoys immunity from legal actions unless they operate in bad faith, which occurs when they operate in a way that the FOS does, as a closed shop.

We’ve been dealing with the Ombudsman for more than a decade. We’ve seen how the system works and where it fails. We know the traps, the blind spots, and the silent rejections. More importantly, we know how to frame a case properly, how to build supporting evidence, and how to avoid the common pitfalls that leave so many with nothing to show for their efforts.

The bottom line is, don’t go it alone. Not because the FOS is evil or corrupt, but because it’s flawed, overworked, and not nearly as impartial as it likes to appear. If you’re serious about getting results, the smart move is to approach it like any other system: with strategy, preparation, and the right kind of support.

"The FOS may be free, but it won’t guarantee the outcome you need or justice you’ll see."